The Impact of Fraud in the Insurance Industry

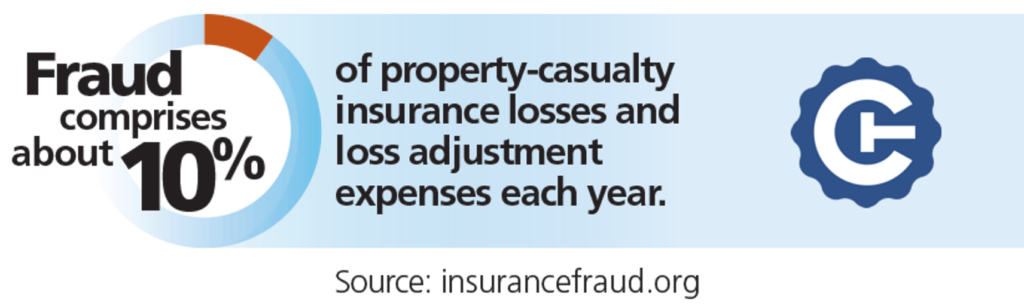

In a recent article disseminated by the Insurance Information Institute the Institute noted that the “The FBI estimates that the total cost of insurance fraud … is more than $40 billion per year. The Institute noted that based on its research dating back to 1980 “fraud accounted for about 10 percent of the property/casualty (PC) insurance industry’s incurred losses and loss adjustment expenses each year. Using that measure, in 2019 and 2020 P/C fraud would amount to $38 billion each year.” [1]

“[I]nvestigators believed the proportion of fraud in global insurance claims to be 22 percent… point[ing] to an estimate of fraud of between $38 billion and $83 billion on average for 2019 and 2020.” Yet “[m]andatory auto insurance photo inspection laws are in effect in only five states: Florida, Massachusetts, New York, New Jersey and Rhode Island…Photo inspections uncovered about $1.8 billion in pre-existing auto damage in New York state from 2014 to 2018…[sav[ing] insurers from paying $128 million in false claims on vehicles.”[2]

“Most insurers have established special investigation units (SIUs) to help identify and investigate suspicious claims…These units range from small teams, whose primary role is to train claim representatives to deal with the more routine kinds of fraud cases, to teams of trained investigators, including former law enforcement officers, attorneys, accountants and claim experts.”[3]

“About 40 percent of insurers polled said their technology budgets for 2019 will be larger…About 90 percent of respondents said they use technology primarily to detect claims fraud …The greatest challenges for insurers are limited IT resources, which affects about three-quarters of insurers…”[4]

So insurance fraud is big business.

Now we have a sense as to the size of the problem. This brings us again to CertifiedTrue’s PhotoProof Saas solution.

In the era of COVID-19 Claims adjusters have been working from home and relying more than ever on digital photographs and videos to inspect and appraise damages submitted by insured/claimants. Indeed even pre-Covid Photo based estimates for auto claims increased to 53 percent of claimants submitting vehicle loss images or videos to insurers.[5]

In the past insurers mostly used Photo based estimates for low-value claims. But with lockdowns in place in many states, insurers expanded this practice larger loss value claims.

Industry pivoted in a time of emergency. Time will tell how much of these practices are continued as folks are returning back to the office.

In time one expects that the industry will strengthen protocols and rebuild checks and balances to guard against fraudulent digital images. However detecting fraud in digital images is labor-intensive, inefficient and difficult on the back end of the proverbial funnel.

Detecting digital images is challenging even for trained experts and most adjusters aren’t trained to detect manipulated images.

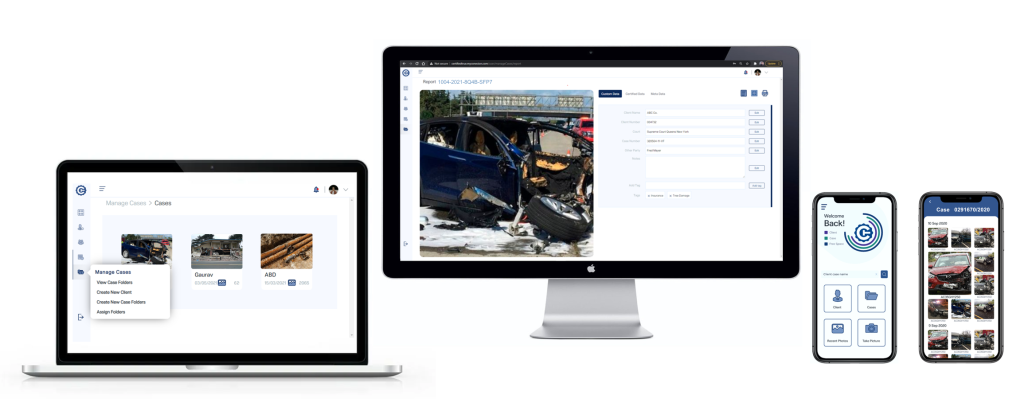

There has to be a better way. Simply stated there is. CertifiedTrue is a B2B SaaS company focused on eliminating the potential for image fraud by providing a platform built on proprietary technology, that enables certification and verification of digital images so that they are reliable as evidence in court or for claim adjudication purposes.

Our SaaS solution, PhotoProof, provides a secure process to capture, certify and verify digital photos and videos with their metadata to be authentic, accurate and original using 4th generation blockchain-inspired technology. Our product provides protection from image fraud. Our app enables capturing, managing and authenticating evidence that is Immutably Registered, Timestamped, GeoTagged and for all intents and purposes, third-party certified as original.

Technology can’t solve every problem.

But CertifiedTrue’s PhotoProof can help in making digital image fraud a thing of the past.

Want to learn more? Click on startengine.com/certifiedtrue

~Bill Clement

[1], [2], [3], [4] https://www.iii.org/